Density Scanner

In the world of cryptocurrencies, trading often depends on a proper understanding of market sentiment and the structure of orders. One of the tools that can help with this is the cryptocurrency density scanner.

Cryptocurrency densities represent the concentration of large buy and sell orders for cryptoassets. Typically, densities are found near support or resistance levels.

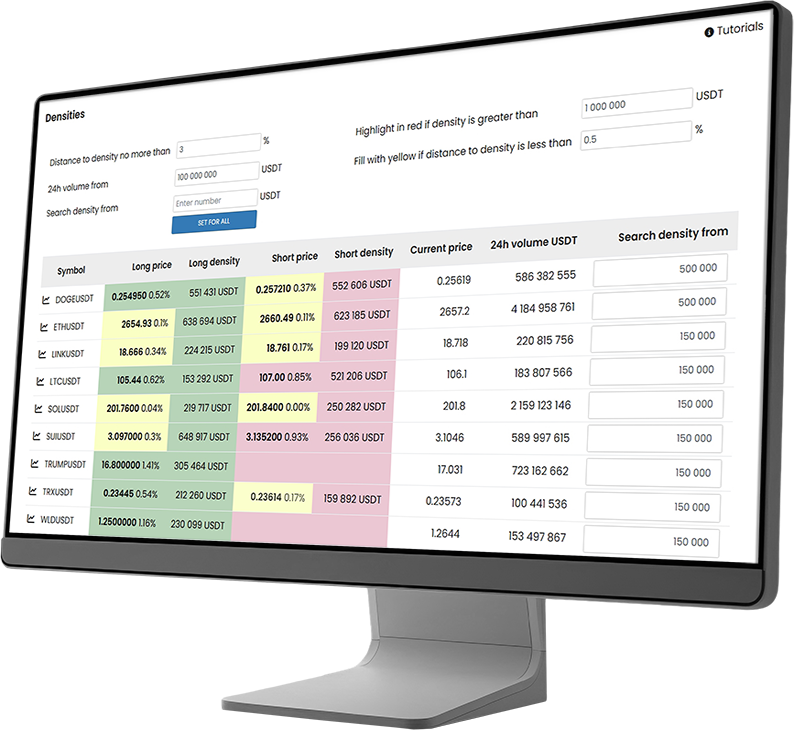

The Density Scanner is a specialized tool that displays large limit orders in the order book. Limit orders set the prices at which traders are willing to buy or sell assets. When many orders are concentrated at one level, this forms what is called a "density". Such levels are usually found near areas of support or resistance, where the price may rebound.

Our scanner finds large limit orders that are capable of actually influencing the price. For each instrument, the density size can be configured individually. You can also set up an asset filter based on 24-hour volume and the distance to the density level.

Why Use the Density Scanner?

Market Analysis

The scanner allows you to see where large limit orders are concentrated. If the scanner shows a density at a certain level, it can indicate where the price might encounter strong resistance or support.

Making Trading Decisions

By knowing where large orders are located, a trader can anticipate in advance that the price will stall or change direction. This information helps determine the appropriate entry or exit points.

Trend Determination

If densities form at key levels, this may indicate a change in the market trend. For example, if buy orders accumulate near a support level, it could be a signal for a price rebound.

The cryptocurrency density scanner is a convenient and visual tool that helps traders navigate the dynamics of lateral and reversal market movements. It allows you to see where large limit orders are concentrated, identify support and resistance zones, and make timely trading decisions. Even if you are new to cryptocurrency trading, the ability to visually assess market pressure will help you better understand market movements and improve the quality of your trading strategies.