Funding Rate Arbitrage

The funding rate is a mechanism designed to maintain balance between the prices of perpetual futures and the spot market prices (where real cryptocurrency is bought and sold). Perpetual futures are contracts for buying or selling cryptocurrency without a fixed expiration date.

Here’s the issue: the price of such a contract can deviate from the real market price (spot price), as it all depends on whether traders are willing to pay more or less for the contract. To prevent excessive deviations, exchanges use the funding rate mechanism.

Who pays the funding rate and to whom?

- If futures are more expensive than the spot price, holders of long positions (longs) pay holders of short positions (shorts).

- If futures are cheaper than the spot price (a short-dominated market), the opposite occurs: shorts pay longs.

These payments are made every few hours (usually every 8 hours), and the funding rate is automatically recalculated depending on the market conditions.

The Cryptata service helps identify funding arbitrage opportunities across various exchanges. You can configure the exchanges, funding rate percentages, and the type of arbitrage you want to pursue.

There are two types of funding arbitrage:

- Funding arbitrage between spot and futures on the same exchange

- Arbitrage based on differences in funding rates between exchanges

Funding Arbitrage Between Spot and Futures

This arbitrage strategy involves performing two simultaneous trades in opposite directions—one on the spot market and the other on perpetual futures—both in equal volumes. The goal is to profit from funding rates while offsetting any price movements between the two positions.

When the funding rate is positive, you buy the asset on the spot market and open a short position in perpetual contracts with an equivalent volume. This generates a stable income from the funding rates, and this strategy is often referred to as "positive arbitrage."

Example

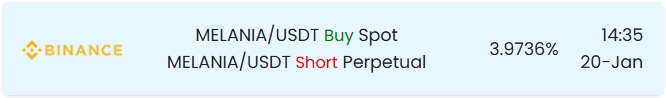

Let’s say we receive a funding rate arbitrage signal for the coin MELANIA, and you have 3000 USDT available in your account. Here’s how the process works:

1. Buy MELANIA on the spot market for 2000 USDT.

2. Open a short position on MELANIAUSDT perpetual futures with a volume of 2000 USDT. Use 10x leverage, meaning your own investment (margin) will only be 200 USDT.

3. Earn funding rate income every 8 hours:

- 2000 USDT × 3.97% = 79.4 USDT.

4. Because you have hedged your position on the spot market, your profit will not depend on the direction of the coin’s price movements. Just make sure that your position doesn't get liquidated by maintaining sufficient margin.

By following this strategy, funding rate arbitrage allows you to generate steady income, provided that you manage your risks effectively.

Arbitrage on Funding Rate Differences Between Exchanges

This strategy takes advantage of the differences in funding rates across various exchanges. By taking a long position on one exchange with a lower funding rate and a short position on another exchange with a higher funding rate, you can profit from this discrepancy./p>

Example

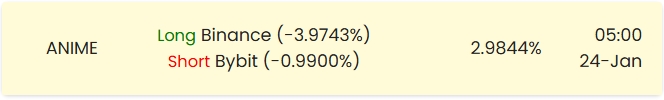

We notice that ANIME perpetual futures have a funding rate of -3.97% on Binance, while the funding rate for the same coin is -0.99% on Bybit. To profit from this difference, you can proceed as follows:

Open a long position on Binance:

Take a 1000 USDT position in ANIMEUSDT perpetual futures with 10x leverage (your margin investment will be 100 USDT).

2. Open a short position on Bybit:

Take a 1000 USDT position in ANIMEUSDT perpetual futures with 10x leverage (your margin investment will also be 100 USDT).

Now, your total position is "locked" (hedged) across both exchanges, and your total investment is 200 USDT.

Profit is derived from the difference in funding rates: - Funding rate profit = 3.97% - 0.99% = 2.98%,

meaning you earn 29.8 USDT every 8 hours.

Important Notes:

When engaging in funding rate arbitrage, always take exchange fees into account to ensure the strategy remains profitable!

Benefits and Risks

Like any earning method, funding rate arbitrage comes with its own set of pros and cons.

Pros:

- Stable income: You earn not from price movements but from payouts by other traders.

- Minimal market risk: Arbitrage involves hedging against price fluctuations.

- Simplicity: Compared to active trading, this method requires less time if everything is set up correctly.

Cons:

- Exchange fees: Trading fees can eat into your profits, especially with frequent transactions. br>

- Funding rate volatility: Funding rates can drop sharply or even reverse direction, reducing your income.

Funding rate arbitrage is a great tool for those who want to earn in the cryptocurrency market with minimal risk. This method is particularly suitable for beginners who wish to explore the market without diving into complex trading strategies. However, it is crucial to remember that successful arbitrage requires thorough market research, minimizing fees, and understanding how the exchange mechanics work.

If you're looking to try this method, start with small amounts to familiarize yourself with the process. And always account for fees and risks to ensure your arbitrage efforts remain profitable!