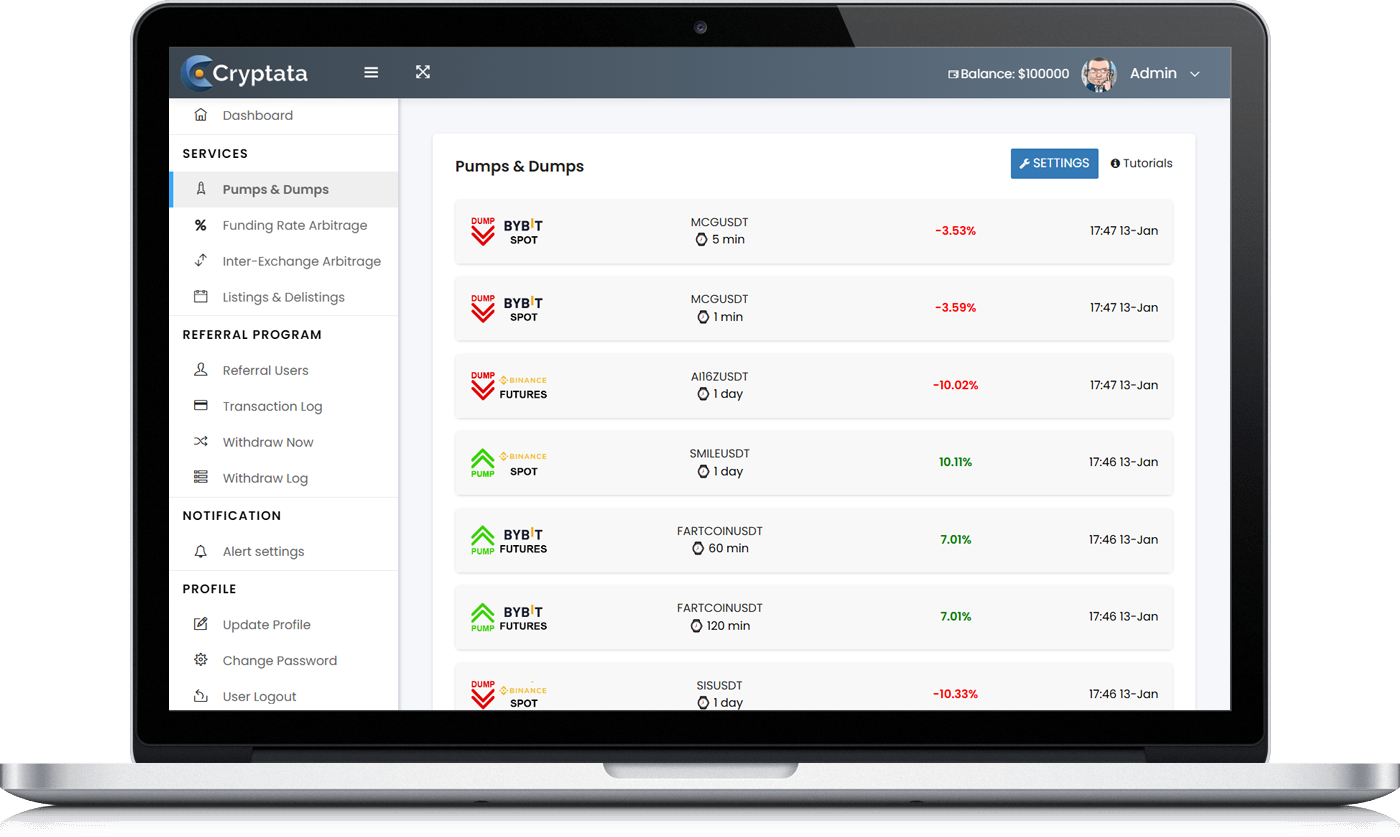

Pumps & Dumps

Our pump-and-dump monitoring tool is designed to detect abnormal market movements and promptly notify users. Abnormal movements primarily refer to increased volatility.

The service identifies market manipulations, such as sudden buying or selling of large volumes of an asset. You can customize the monitoring parameters: select the desired timeframes and specify the percentage change in price.

Let’s go over the signals you will receive on the website or via Telegram.

There are only 2 types of signals:

- The coin has increased by the specified percentage (Pump)

- The coin has decreased by the specified percentage (Dump)

The service can be used as:

- A scalping tool

- A pump tracker (spot/futures trading with minimal leverage)

- A supplementary tool for market monitoring

As a Scalping Tool

The primary function of the screener is to provide signals for scalping. The screener’s algorithm is specifically designed to detect manipulations (pumps and dumps) that are typically followed by a rollback or even a full reversal of the impulse. In other words, when we receive a pump or dump signal, we can trade against the direction of the move.

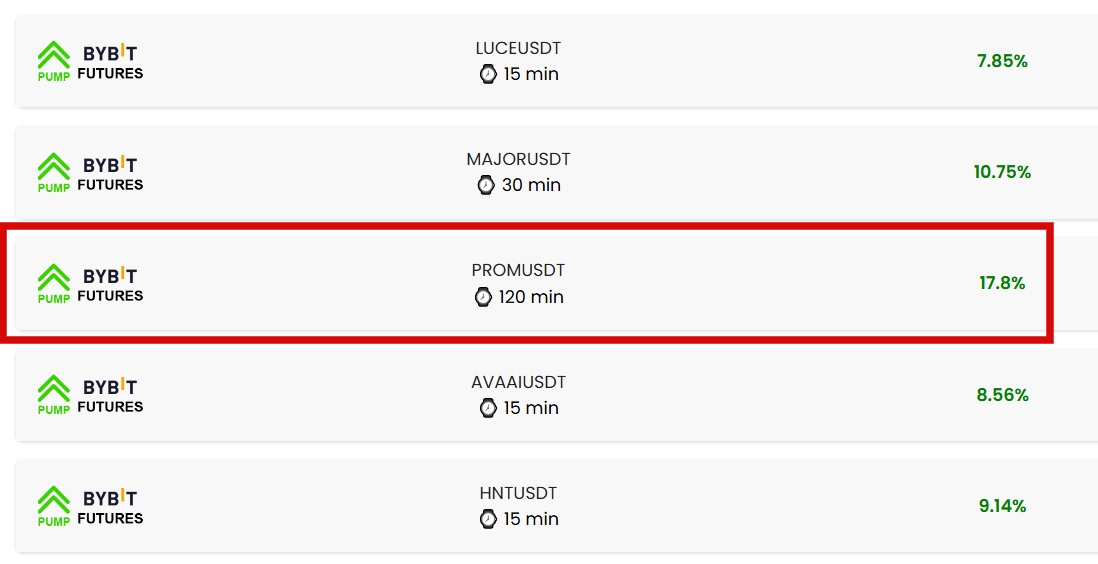

Let's look at an example of using a signal on the coin PROM

An obvious manipulation that can be confidently shorted

By using proper risk management and entering after confirmation, we were able to easily secure a profit

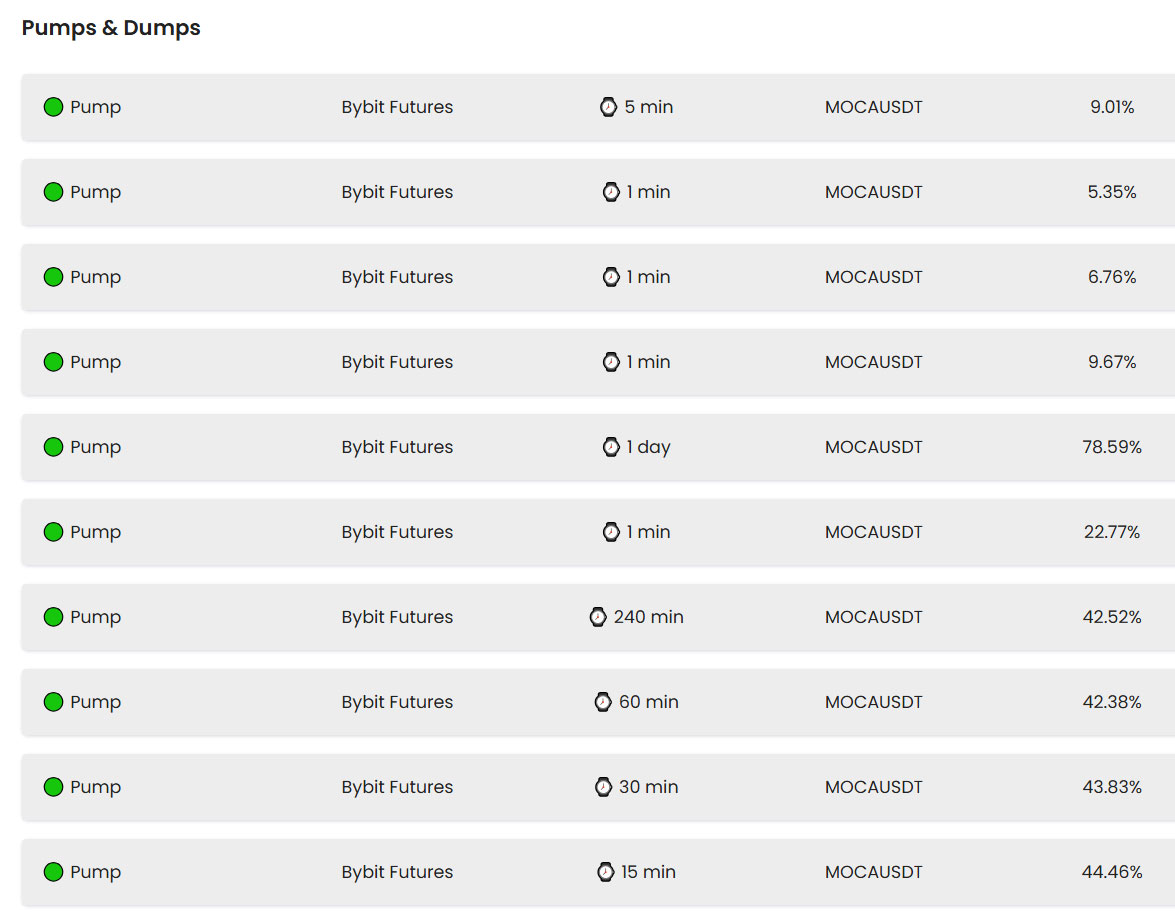

Another example with the coin MOCA

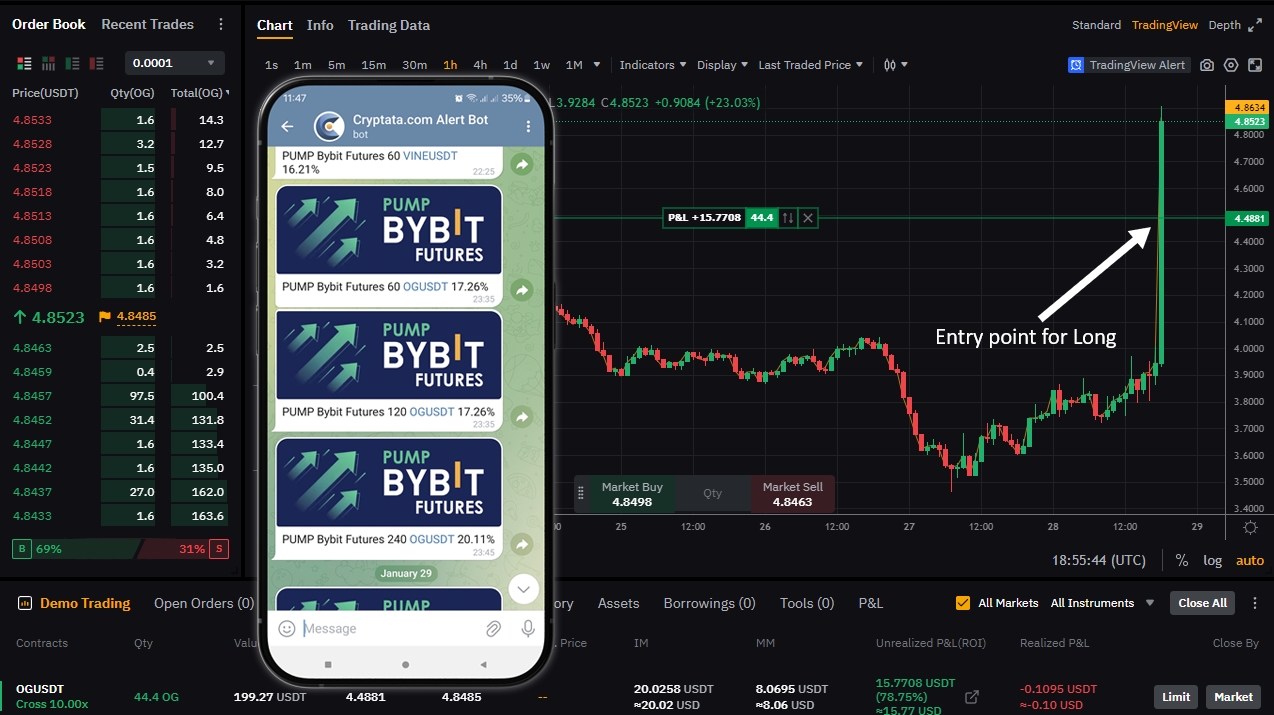

As a Pump Tracker

However, not all pump signals from the screener should be shorted, just as not all dump signals should be bought back. In some cases, the screener identifies genuine "pumps and dumps" rather than routine manipulations. In some cases, the screener detects actual "pump-and-dump" events. In such situations, traders can capitalize on the continuation of the movement, sometimes securing price changes of up to several hundred percent.

Example: Received several signals about a pump of the OG coin on different timeframes. Opened a Long position to follow the continued price increase.

As a Supplementary Tool for Market Monitoring

First and foremost, our product is a screener designed to provide you with up-to-date market data. With its help, you can promptly stay informed about:

- Global market changes

- The emergence of new coins

- Pump and dump events

All this makes the screener not only a tool for generating trade signals but also an indispensable assistant for navigating and working in the market.